HSBC GIF Multi-Asset Style Factors

Best performing fund in Hedge Fund Journal’s “Alternative Risk Premia” category over 3, 4 and 5 years

In the Alternative Risk Premia category, HSBC GIF Multi-Asset Style Factors is the best performing fund over the following time periods:

- Over 3 years with a return of 4.03% and a Sharpe of 0.81

- Over 4 years with a return of 3.65% and a Sharpe of 0.73

- Over 5 years with a return of 4.56% and a Sharpe of 0.89

The success of HSBC GIF Multi-Asset Style Factors shows our ability to build innovative multi-asset solutions which can deliver robust performance even in stressful environments like 2018 and 2020. Academic and practitioner-oriented research lie at the heart of our process. Alternative premia selection, portfolio construction and careful implementation play a key role in our approach. I am delighted that the innovation and robustness of our strategy are recognized by this award.

- Jean-Charles Bertrand, Global CIO Multi-Asset

Read the fund manager interview

More relevant than ever

Despite the recent correction, expected returns on traditional asset classes are low on average. HSBC GIF Multi-Asset Style Factors (MASF) has delivered robust risk-adjusted returns since inception and proved resilient in the challenging years of 2018 and 2020.

Main risks: capital loss, equity, interest rate, foreign exchange, emerging market, derivatives, counterparty, model

Source: HSBC Global Asset Management. Data as at 29/01/2021. * Weekly data from inception on 07/10/2016 to 29/01/2021.

Past performance is no guarantee of future returns. Future returns will depend inter alia on market developments, the fund manager’s skill, the fund’s level risk and management costs and if applicable subscription and redemption costs. The return, the value of money invested in the fund may become negative as a result of price losses and currency fluctuations. There is no guarantee that all of your invested capital can be redeemed. Unless stated otherwise, inflation is not taken into account. The performances are displayed gross of fees. The application of the fees will have the effect of reducing the performances presented.

Key features

- Vehicle: UCITS Luxembourg domiciled fund

- Inception: 07/10/2016

- Performance objective: Cash +5% (gross of fees)

- Target volatility: 6-8%

- Investment universe: major equity, bond and currency markets at the macro/index level (no individual stock/bond)

- Developed and Emerging equity

- Government bond

- Developed and Emerging currency

- Maximum directional exposure for each asset class (either long or short):

Source: HSBC Global Asset Management. Characteristics and weightings are for information only, are not guaranteed and are subject to change over time, and without prior notice, taking into account any changes in markets.

Important information

Before subscription, investors should refer to the Key Investor Information Document (KIID) of the fund as well as its complete prospectus. For more detailed information on the risks associated with this fund, investors should refer to the prospectus of the fund.

HSBC GIF Multi-Asset Style Factors is exposed to the main following risks:

It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed

- Equity risk: portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements

- Interest rate risk: as interest rates rise debt securities will fall in value. The value of debt securities is inversely proportional to interest rate movements

- Foreign exchange risk: where overseas investments are held, the rate of exchange of the currency June cause the value to go down as well as up

- Emerging market risk: Investments in emerging markets have by nature higher risk and are potentially more volatile than those made in developed countries. Markets are not always well regulated or efficient and investments can be affected by reduced liquidity

- Derivative risk: the value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative

- Counterparty risk: The portfolio is exposed to Over the Counter (OTC) markets for all or part of its total assets. The portfolio will therefore be subject to the risk that its direct counterparty will not perform its obligations under the OTC transactions and that the strategy will sustain losses

- Model risk: Model risk occurs when a financial model used in the portfolio management or valuation processes does not perform the tasks or capture the risks it was designed to. It is considered a subset of operational risk, as model risk mostly affects the portfolio that uses the model

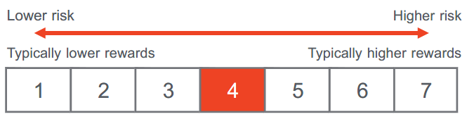

Risk Reward Profile

The rating is based on price volatility over the last five years, and is an indicator of absolute risk. Historical data may not be a reliable indication for the future. The rating is not guaranteed to remain unchanged and the categorisation may shift over time. The lowest rating does not mean a risk-free investment. Do not run any unnecessary risk. Read the Key Investor Information Document.

Notes:

Swing pricing: The fund uses the swing principle calculation method which determines the net asset value of the fund. Swing pricing allows investment funds to pay the daily transaction costs arising from subscription and redemptions by incoming and outgoing investors. The aim of swing pricing is to reduce the dilution effect generated when, for example, major redemptions in a fund force its manager to sell the underlying assets of the fund. These sales of assets generate transaction costs and taxes, also significant, which impact the value of the fund and all its investors.

Gates: the fund has a redemption threshold (gate), the level at which the manager of an undertaking for collective investment in transferable securities can stagger the redemption of securities instead of proceeding immediately.