CHF-Hedged Share Classes

As part of HSBC Asset Management’s drive to offer investors a broader array of investment tools, HSBC has launched currency hedged variants of a number of different ETFs within its product range.

Efficient Currency Hedge

Currency-hedged ETFs are useful because they remove the uncertainty of exchange rate fluctuations. Currency risk can either work for or against your position and in the absence of a currency view, a currency hedged exposure is recommended.

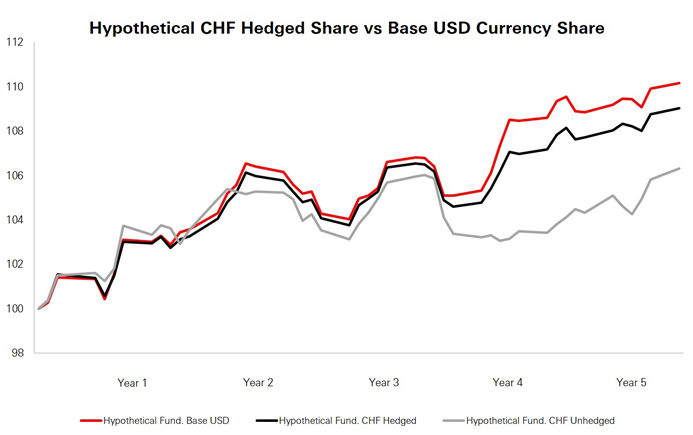

A hypothetical example of how a hedged share class and an unhedged share class behave relative to the base currency

Below, as an example only, shows the performance over a 5-year track record of a hypothetical fund in the base currency USD versus the hedged CHF share price and the unhedged CHF share price.

The above is a hypothetical example only. It does not represent the return of any specific investment.

What does this show and what does it mean for investors with a hedged share class?

The graph above shows that investors with a CHF hedged share class of the hypothetical fund can receive a return that is closely correlated with the USD base currency. There can be no guarantee that hedging currency risks will be successful and there could be discrepancies between the currency position of the fund and the hedged share class especially during periods of significant market volatility.

The latest CHF-hedged opportunity for investors

The HSBC MSCI World UCITS ETF was launched in 2010 and it currently has an AUM of USD 13.9bn*. The MSCI World Index captures large and mid-cap representation across 23 Developed Markets (DM) countries*. With 1,325 constituents, the index covers approximately 85 per cent of the free float-adjusted market capitalization in each country.

*Source: HSBC Asset Management as of end of June 2025.

|

|

|

Access the Opportunities

|

HSBC MSCI World UCITS ETF (CHF-Hedged) |

More information |

|

HSBC S&P 500 UCITS ETF (CHF-Hedged) |

More information |

|

HSBC FTSE EPRA NAREIT Developed UCITS ETF (CHF-Hedged) |

More information |

|

HSBC Global Funds ICAV - Global Sustainable Government Bond UCITS ETF (CHF-Hedged)

|

More information |

|

HSBC Global Funds ICAV - Global Government Bond UCITS ETF (CHF-Hedged)

|

More information |

|

HSBC Global Funds ICAV - Sustainable Development Bank Bonds UCITS ETF (CHF-Hedged)

|

More information |

|

HSBC Global Funds ICAV - Global Corporate Bond UCITS ETF (CHF-Hedged)

|

More information |

|

HSBC Global Funds ICAV - Global Aggregate Bond Index Fund (CHF-Hedged)

|

More information |

|

HSBC Global Funds ICAV - Euro Corporate Bond UCITS ETF XCHCHF

|

More information |

|

HSBC Global Funds ICAV - Euro Lower Carbon Government 10+ Year Bond UCITS ETF SCHCHF

|

More information |

|

HSBC Global Funds ICAV - Euro Lower Carbon Government 1-3 Year Bond UCITS ETF SCHCHF

|

More information |

|

HSBC Global Funds ICAV - Global Aggregate Bond ESG UCITS ETF S6CHCHF

|

More information |

|

HSBC Global Funds ICAV - Japan Government Bond UCITS ETF SCHCHF

|

More information |

|

HSBC Global Funds ICAV - US Corporate Bond UCITS ETF XCHCHF

|

More information |

Key Risks

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested.

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

- Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

- Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly

- Index Tracking Risk: To the extent that the Fund seeks to replicate index performance by holding individual securities, there is no guarantee that its composition or performance will exactly match that of the target index at any given time (“tracking error”)

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source

- Liquidity Risk: Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors

- Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things

- Currency hedging risk: For CHF-hedged share classes, currency hedging transactions are used to reduce the impact of exchange rate fluctuations between the base currency of the fund and the CHF. However, such hedging may not be perfect and could eliminate potential gains or exacerbate losses. Hedging costs could also impact the overall performance of the share class. There is no guarantee that hedging will be successful

The value of investments and any income from them can go down as well as up, and investors may not get back the amount originally invested. Where overseas investments are held, fluctuations in currency exchange rates may impact returns. For CHF-hedged share classes, currency hedging aims to reduce the impact of exchange rate movements between the fund’s base currency and the CHF, but there is no guarantee that such hedging will be fully effective.

Hedging may limit potential gains or increase losses. Investments in emerging markets carry a high level of risk and may be subject to greater volatility and reduced liquidity compared to developed markets. Any performance information shown refers to the past and should not be seen as an indication of future returns.