HSBC PLUS Active ETFs

Activate your portfolio’s potential with ETFs designed with discipline

and built with precision

Access the power of PLUS

HSBC PLUS Active ETFs

Through a disciplined, quantitative investing approach, HSBC’s PLUS Active ETF range helps investors access the potential for excess returns.

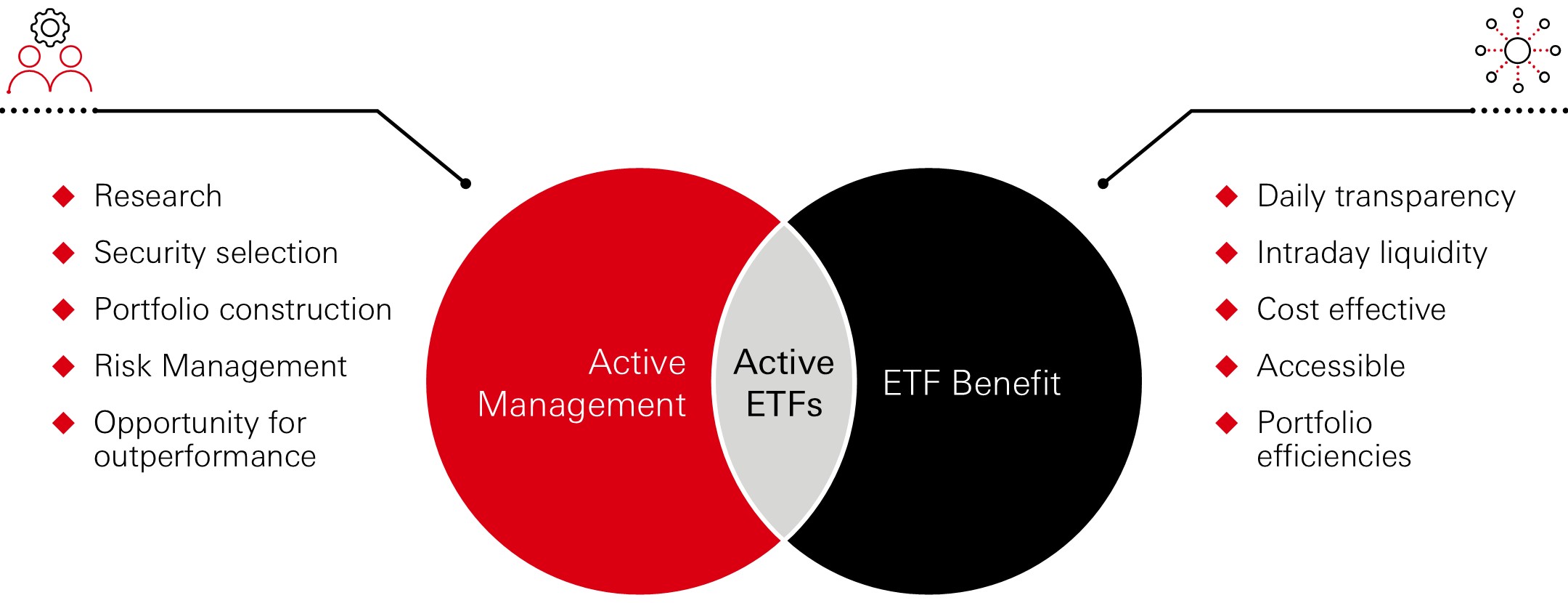

Active ETFs combine the benefits investors have come to value from ETFs — transparency, liquidity, broad diversification, and cost efficiency — with the potential for market outperformance in a risk-controlled manner.

Designed with discipline, our active ETFs offer investors enhanced core portfolio exposure and heightened diversification alongside existing ETF portfolios to aid in reducing investment process risk.

Three BIG reasons to choose HSBC PLUS Active ETFs

The benefits of Active ETFs

Explore our range

|

|

|

|

|

|

|

|

|

|

|

|

Speak with the team

Sales contacts

Roland Fischer Head of ETF & Indexing Sales

Switzerland & Liechtenstein

*For professional clients only.

Key Risks

Further information on the potential risks can be found in the Key Investor Information Document (KIID) and/or the Prospectus.

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested.

◆ Counterparty Risk The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

◆ Derivatives Risk Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

◆ Emerging Markets Risk Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

◆ Exchange Rate Risk Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

◆ Investment Leverage Risk Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

◆ Liquidity Risk Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

◆ Operational Risk Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

◆ Real Estate Investments Risk Real estate and related investments can be negatively impacted by any factor that makes an area or individual property less valuable.

Important Information

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The presented funds are not authorized for public offering in Switzerland under Article 120 of the Federal Act on Collective Investment Schemes (CISA, KAG).

This material is exclusively intended for professional investors as defined in Article 4(3)(a-g) of the Swiss Financial Services Act (FinSA, FIDLEG).

This material is not intended for:

- Professional clients who are not institutional clients under Article 4(4) FinSA and who wish to opt-in for treatment as retail clients under Article 5(5) FinSA.

- High-net-worth (HNW) retail clients and private investment structures created for them, who may declare themselves as professional investors (opting out).

Additional opting-in and opting-out options are available under FinSA. For further details, please refer to our website: https://www.assetmanagement.hsbc.ch/. If you wish to change your client categorization, please inform us.

Important Notice

When distributing this material solely to professional investors, the local business developer/client services team must include a copy of the Key Information Document (KID) and the Prospectus in the documentation. Please refer to the investor category overview for further details. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich.

Investments in financial instruments carry general risks. For further details, please refer to the Swiss Bankers Association (SBA) brochure: "Risks Involved in Trading Financial Instruments“.

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.