Real Estate APAC

Dedicated Asia Pacific direct Real Estate investment manager

Who we are

Our Real Estate APAC team provides investors access to value-add and core-plus investment approaches, leveraging our long track record and presence in the region.

Significant resources with deep

|

General Partners retain “Skin-in-the-game”

|

Established business with proven track record

|

Differentiated investment approach with deep relationship network

|

Source: HSBC AM, as of June 2024

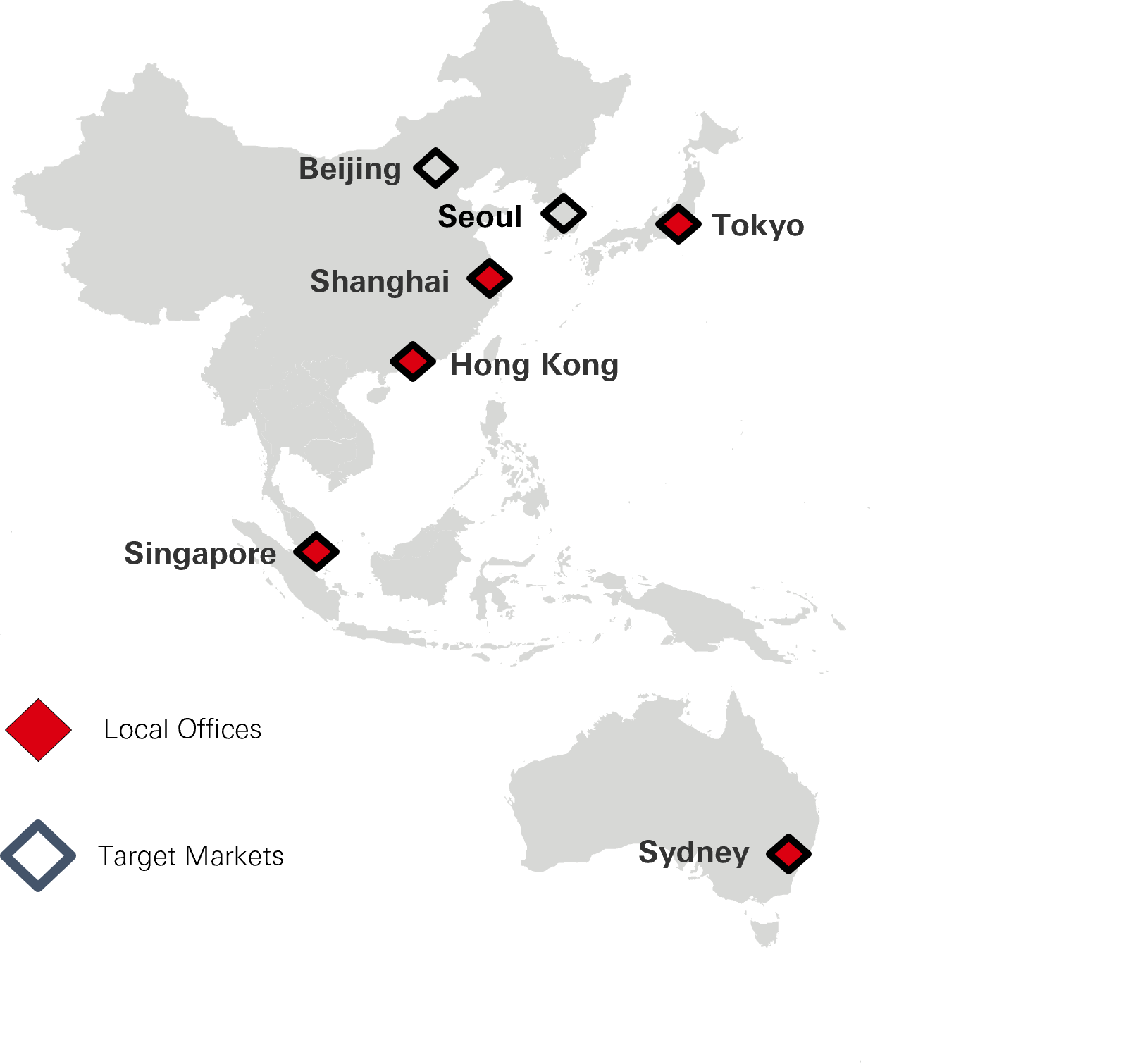

We target the most mature, institutionalised, liquid and transparent markets in the Asia Pacific Region

Our Investment Approach

|

Invest

Optimise Execute SAP, which can include these active AM initiatives to create value:

Realise

|

What we do

Our Portfolio

Our team currently manages over 20 properties in the region – representative properties include:

Experienced Investment Team

Average years of experience of senior leadership |

Average years key investment members have worked as a team |

Investment professionals based locally across APAC |

Our Team

25 investment professionals locally based across APAC

Peter Wittendorp, CEFA Head of Real Estate, APAC 30 years of real estate experience |

|||

Berend Poppe, CFA Head of China 20 years real estate experience |

Nick Kearns, CFA Head of Hong Kong 20 years real estate experience |

George Kang Head of Singapore 20 years real estate experience |

Takashi Hamajima Head of Japan 20 years real estate experience |

Contact us

Key Risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

The risk factors listed below are not exhaustive.

General Real Estate Risk: The investments will be subject to risks incidental to owning and operating real estate projects, including risks associated with the general economic climate, geographic or market concentration. There is no guarantee in respect of the repayment of principal or the value of investments, and the income derived therefrom may fall as well as rise. Investors therefore may not recoup the original amount invested. In particular, the value of investments may be affected by political and economic news, government policy, changes in technology and business practices, changes in demographics, cultures and populations, natural or human-caused disasters, pandemics, weather and climate patterns, scientific or investigative discoveries, costs and availability of energy, commodities and natural resources. The effects of market risk can be immediate or gradual, short-term or long-term, narrow or broad.

Liquidity Risk: Private real estate, including investments made directly or through corporate or fund structures, is an illiquid asset class. Investors should be warned that there may not be a secondary market for their shares or interest in the fund or partnership. Liquidity risk may arise due to challenges in selling assets quickly, and it may require a substantial length of time to liquidate.

Tenure Risk: Institutional direct real estate investments are typically underwritten with a long holding period and are only suitable for investors who have a long-term investment horizon.

Economic Conditions: The economic cycle and prevailing interest rates will impact the fundamentals of the underlying investments. Economic activity and sentiment also impacts the performance of underlying companies and could have a direct bearing on the ability of companies to keep up with interest and principal repayments.

Risks Associated with Certain Types of Real Estate: In addition to the general real estate risks described above, other factors that may adversely affect the value and successful operation of, and income generated from, certain types of real estate investments includes the following: the physical attributes of a building used to generate income, location of the property , ability of management to provide adequate maintenance and insurance, the types of services or amenities that the property provides, the property's reputation, competition from other real estate investors, the level of mortgage interest rates, presence or construction of competing properties, the quality of tenants and tenant mix and adverse local, regional or national economic conditions. This list is not exhaustive and there could be other factors could have a material adverse effect on the performance of an investment.

Important Information

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The presented fund is not authorized for public offering in Switzerland under Article 120 of the Federal Act on Collective Investment Schemes (CISA, KAG).

This material is exclusively intended for professional investors as defined in Article 4(3)(a-g) of the Swiss Financial Services Act (FinSA, FIDLEG).

This material is not intended for:

- Professional clients who are not institutional clients under Article 4(4) FinSA and who wish to opt-in for treatment as retail clients under Article 5(5) FinSA

- High-net-worth (HNW) retail clients and private investment structures created for them, who may declare themselves as professional investors (opting out)

Additional opting-in and opting-out options are available under FinSA. For further details, please refer to our website: https://www.assetmanagement.hsbc.ch/. If you wish to change your client categorization, please inform us.

Important Notice

When distributing this material solely to professional investors, the local business developer/client services team must include a copy of the Key Information Document (KID) and the Prospectus in the documentation. Please refer to the investor category overview for further details.HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich.

Investments in financial instruments carry general risks. For further details, please refer to the Swiss Bankers Association (SBA) brochure: "Risks Involved in Trading Financial Instruments."

Experienced leadership team

Experienced leadership team