Uncovering the Asia Premium in Infrastructure without Increasing Risk

Sector-focused, mid-market strategies in developed Asia Pacific can offer institutional investors differentiated access to growth, policy certainty, and a pathway to higher risk-adjusted returns.

Introduction

Within the world’s fastest growing economic region, we see developed Asia Pacific markets on the cusp of an energy revolution.

At a time when the world is becoming increasingly fractured along geopolitical and economic lines, energy security and affordability are becoming higher priorities. Most Asia-Pacific countries, including the developed markets, are fossil fuel importers, so have a clear incentive to achieve energy self-reliance through switching to renewable energy and building energy infrastructure and grid capacity. The energy transition also comes with the potential for economic benefits in the form of transition-related manufacturing and exports and job creation. These economic and security drivers sit alongside important environmental objectives, collectively underpinning strong government policy positions for the transition to clean, domestically-sourced, affordable energy.

Therefore, it’s not surprising that Asia has emerged as a key player in the global energy landscape, both as a major consumer and as a rapidly growing market for renewable energy. For institutional investors, we believe these shifts represent an opportunity to gain exposure to energy infrastructure developments in fast-growing and well-governed countries with the potential for stable inflation-protected yields and valuable portfolio diversification.

Rethinking Infrastructure Value in the Energy Transition Era

Energy transition infrastructure (ETI) is a major infrastructure sector and represents an active pathway to growth that is aligned with government policy and corporate objectives, and that generates long-term value. For institutional investors, ETI should no longer be viewed solely as a defensive yield play or as a niche sustainability play.

Addressing climate mitigation in line with the Paris Agreement goals and ensuring effective climate adaptation, as well as achieving the additional objectives of security and affordability, requires a systems-level multi-sector approach. Reducing emissions requires a shift away from polluting fossil fuels to renewable energy. Yet, going renewable requires grid modernisation. Upgraded interconnected grids enable the integration of renewables, ensuring efficient energy distribution and demand-side management.

Another challenge is the intermittency of wind and solar energy, which is being addressed by increasingly effective energy storage solutions. Battery Energy Storage Systems (BESS) are scaling rapidly, with costs falling in recent years, and 40 per cent from 2023-24 alone.1 Greening power systems enables the scaling of electric vehicles without a concurrent increase in emissions.

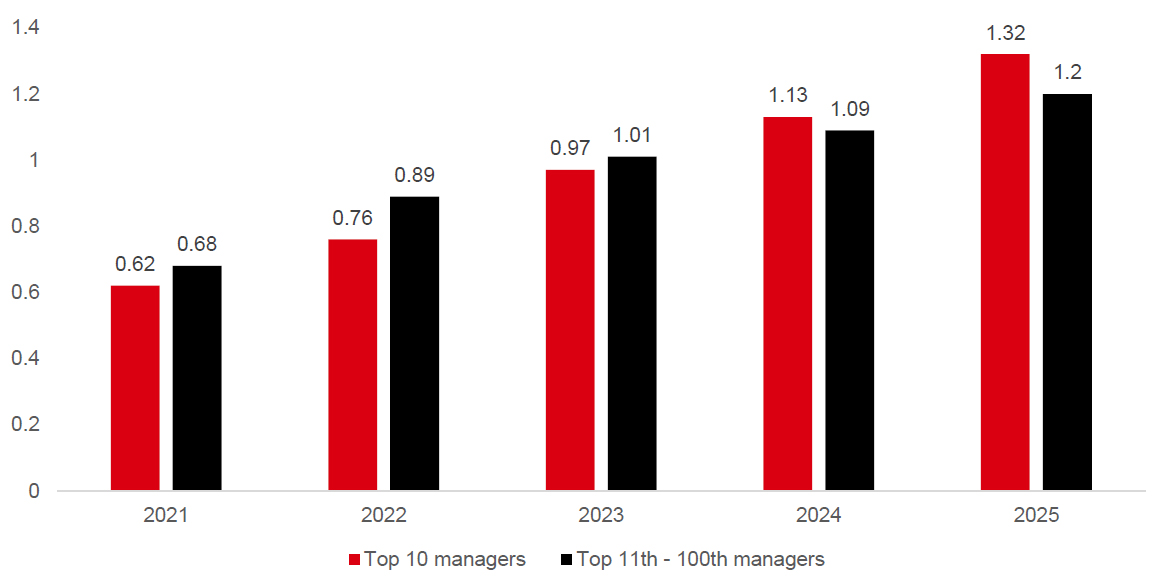

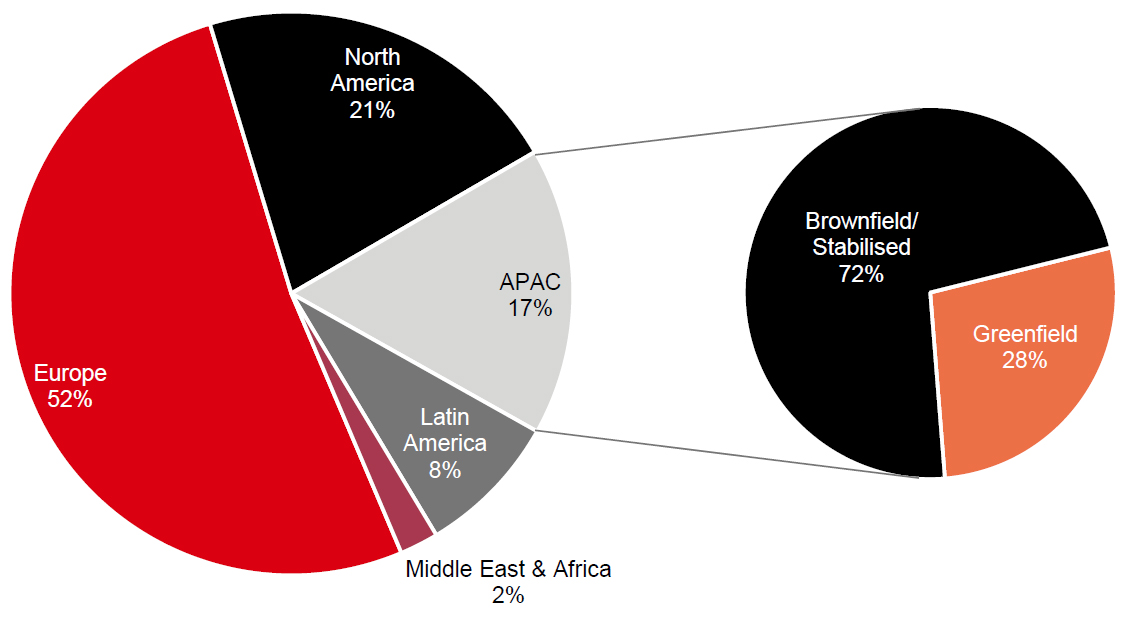

Investors can benefit from these trends, and indeed large amounts of capital has and is flowing to this major sector globally. However, capital flows have been unbalanced - most investor portfolios are overallocated to large, global, generalist infrastructure funds, which tend to focus on (i) brownfield or stabilised assets in (ii) crowded Western markets. They are underexposed to the large growth opportunities in development of new assets and sectors, and the growth engine of Asia Pacific.

Allocations to top 10 managers vs the rest (EUR trillion)

Click image to enlarge

Source: IPE Research, Aug 2025

Renewable Transactions (Equity) by Geography, 2015 – 2024

Click image to enlarge

Source: Infralogic, 2025

A large driver of this unbalanced approach is perceived (in some cases, actual) lower risk and consequently increased investor comfort in Western markets, as compared to Asia-Pacific (as a whole).

So how can investors uncover the return premium that comes with increasing exposure to the growth opportunities and diversification benefits of ETI in Asia-Pacific, without having to take on actual (or perceived) additional risk? A potentially compelling alternative could be sector-specialist, mid-market infrastructure, focused specifically in the developed Asia-Pacific markets. Here, investors can access differentiated asset creation opportunities, including development, construction, system integration, and lifecycle repowering. Investors can also gain early exposure to high-growth sub-sectors like electric vehicle charging, energy storage, and other ancillary technologies, where Asian countries are playing catch up to their Western counterparts. Finally, a mid-market approach can open up a larger opportunity set of potential deals than the large- or mega-cap market, with potentially more attractive entry valuations and value creation levers.

Why Developed Asia-Pacific? Examining the Policy Bedrock

Collectively, Bloomberg NEF estimates that USD 88.7tn is required by 2050 to align the Asia-Pacific region with the Paris Agreement goals. The Asia-Pacific renewable energy market, valued at USD 330.5bn in 2024 is projected to more than double to USD 711.8bn by 2033, representing an 8.9 per cent compound annual growth rate.

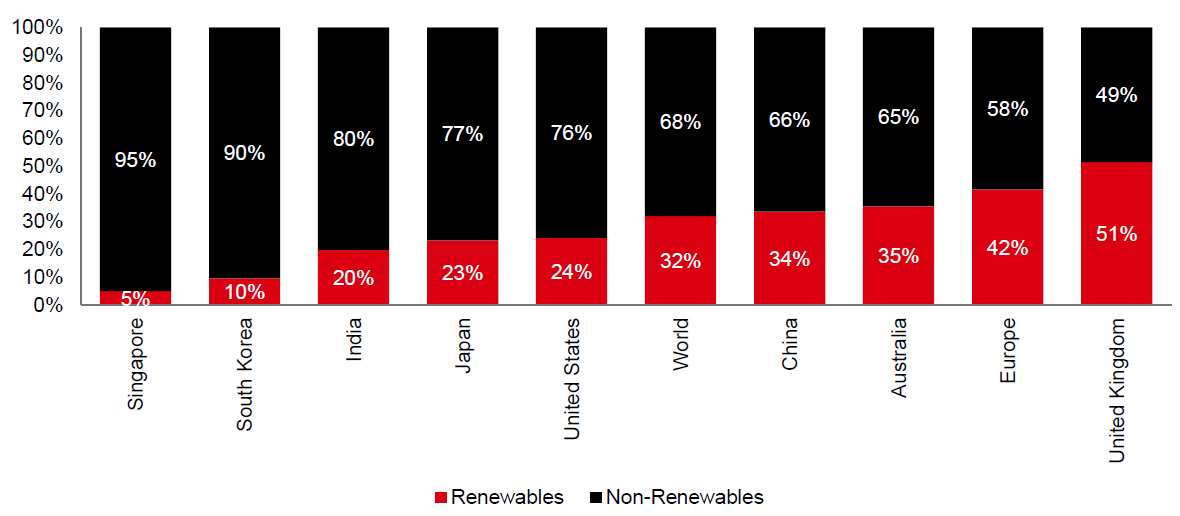

A significant component of that growth is the simple fact that key markets in Asia Pacific are behind their Western counterparts (especially UK and Western Europe) in terms of renewable energy penetration and overall progress towards transition goals. This means multiples more annual investment is needed compared to historical investment, in order to catch up.

Click image to enlarge

Source: Ember, 2025

The Asia Pacific region has higher growth prospects than North America and Europe, and many countries in the region, including developed markets, are materially less progressed in the energy transition, so the potential opportunity set for institutional investors is compelling.

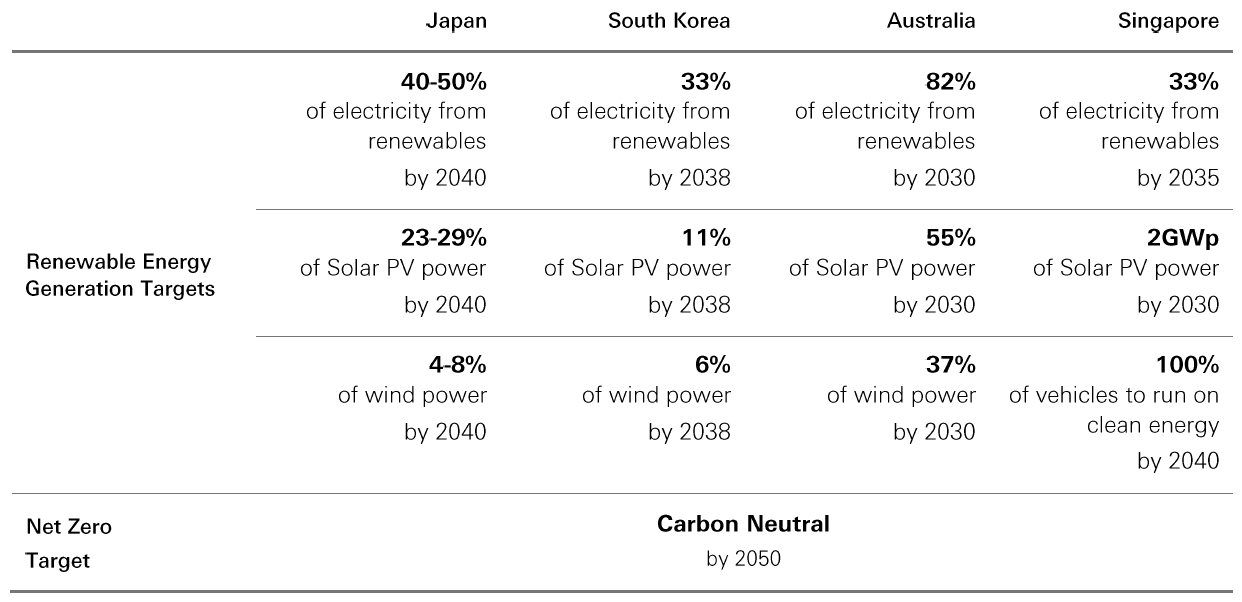

Further underpinning the investment opportunity in ETI, many developed Asia-Pacific countries have implemented ambitious national policies aimed at decarbonization. Policy certainty is a cornerstone of infrastructure investing, and so policy support (on both sides of politics) reduces overall risk in the sector.

Click image to enlarge

Source: Japan METI: “7th Strategic Energy Plan”; South Korea MOTIE: “11th Basic Plan for Long-Term Electricity Supply and Demand”; Australia Government DCCEEW; Singapore EDB and MND.

In addition, across developed Asia Pacific, governments are not just regulators, they are also market-makers, for example:

- Australia: The federal government is backing AUD 2bn in green hydrogen subsidies, and state-level auctions for solar-plus-storage are scaling rapidly, particularly in New South Wales and Victoria3

- Japan: The Ministry of Economy, Trade and Industry (METI) supports large-scale battery energy storage auctions with 20-year fixed capacity payments. The 2040 renewables target of 40-50 per cent is backed by transparent feed-in premium systems and long-term procurement frameworks4

- Singapore: Through its Carbon Pricing Act, energy import targets of 4–6 GW by 2035 (33 per cent of forecasted energy demand then) , and floating solar/storage pilots, Singapore is creating a low-carbon investment framework built on certainty and international credibility5

- South Korea: With the Hydrogen Economy Roadmap and SAF mandates, Korea is investing heavily in infrastructure for industrial decarbonisation, while expanding grid storage and clean tech manufacturing zones6

Across these markets, infrastructure policy is institutionally embedded, long-term, and backed by budgetary mechanisms—lowering entry and operational risk for asset creation investors.

Finally, countries like Australia, Japan, Singapore and South Korea also possess many of the general political and economic hallmarks of developed Western countries that are positive for capital investment. This includes adherence to the rule-of-law, strong governance, robust institutions, stable currencies, and deep capital markets.

This uncommon combination of a high growth, policy-backed sector within politically and economically stable markets, provides the opportunity to capture growth-market returns with developed market risk.

Value Drivers: Where the Asia Premium Is Found

Rather than relying solely on de-risked, large-scale, brownfield assets, regional specialists in Asia Pacific are delivering returns through a variety of mechanisms:

- Asset Creation (Development + Construction)

By entering earlier in the asset lifecycle, investors can capture the premium from origination, permitting, and project structuring. The developed Asia-Pacific market has mature permitting frameworks and structured auctions, which help de-risk early-stage exposure while preserving return uplifts - High-Growth Sub-Sectors

Examples include:

- Solar and wind generation across Asia: penetration of renewable energy generation capacity in Asia Pacific, including developed markets, is materially lagging more mature Western markets, meaning multiples more annual investment is needed compared to historical investment7

- Electric vehicle (EV) charging in Singapore: The government aims for 60,000 public chargers by 2030—up from under 5,000 today—creating investable cashflow models in a highly urbanised and regulated environment8

- Battery storage in Japan: The Ministry of Economy, Trade and Industry (METI) Battery Energy Storage System (BESS) auctions in 2024 alone supported over 1.3 GW of new capacity with multi-revenue models, blending capacity payments with spot price arbitrage9

- Green hydrogen in Australia and Korea: Export-linked hubs in Northern Australia and demand-side incentives in Korea make these early-stage subsectors key drivers of long-term alpha10

- System Optimisation and Lifecycle Value

The ability to add co-located storage to solar, extend project life through repowering, or secure merchant market enhancements over time creates a second layer of upside—often missing in fully stabilised portfolios.

Example: Adding two-hour storage to a 50 MW solar plant in Japan can increase project IRR by 300–500bps through stacked revenues (capacity, arbitrage, and system services) - Mid-market Focus

In the energy transition sector and when narrowing focus to selected developed Asia-Pacific markets, the mid-market offers vastly more investment opportunities, allowing greater deal selectivity, lower competition, bilateral negotiating positions, and greater value creation potential during ownership

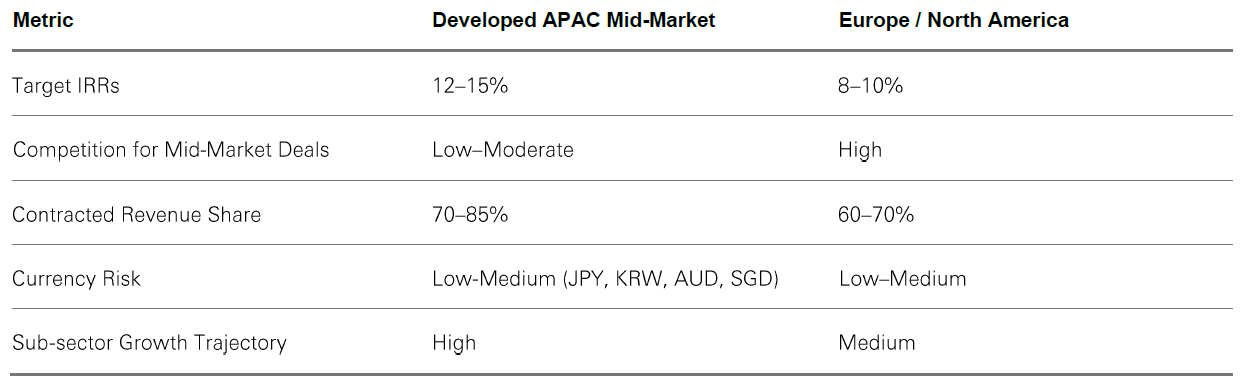

A Return Profile Built on Structural Differentiators

Click image to enlarge

Source: HSBC Asset Management, 2025

Why Regional Sector Specialists Are Key

The complexity of energy markets—policy nuances, grid access regimes, procurement processes—favours teams with deep local presence. Generalist funds and/or funds headquartered out of region are often structurally disadvantaged in sourcing or executing such deals.

Regional specialists in Asia Pacific:

- Understand the subtleties of each market

- Leverage local developer partnerships for origination and execution

- Are equipped to manage project risk across the lifecycle, not just post-COD

Portfolio Design for Institutional Investors

To capture the Asia Pacific premium, investors should consider:

- Allocating a meaningful (e.g. 5–10 per cent) portion of their infrastructure portfolio to mid-market, sector-focused Asia mandates

- Prioritising asset creation strategies with flexibility to invest across development, construction, and early operations

- Diversifying across high-growth subsectors (EVs, BESS, Hydrogen) and core technologies (including solar and grid infrastructure)

- Partnering with managers offering local expertise and boots-on-the-ground, with alignment through co-investment or milestone-based fee structures

A Potentially Compelling, Underappreciated Opportunity

Developed Asia Pacific infrastructure is often overlooked by global allocators due to its perceived complexity or unfamiliarity. However, the region offers a rare alignment of factors:

- Policy stability and support

- Structural growth

- Under-capitalised mid-market access

- Multiple value drivers beyond yield

By pivoting from passive allocations in generalist mega-funds toward focused, regional asset creation strategies, investors can unlock growth-like returns with infrastructure-like risk profiles in some of the most investable jurisdictions in the world.

Multiple tailwinds exist for investors considering allocating to energy transition infrastructure in Asia-Pacific, including an increasing focus on green growth and green alignment across the region, maturing of blended finance mechanisms, and long-term incentives for supply chain resilience. Now is the time to invest in the Asia green transition.

1 BNEF finds 40 per cent year-on-year drop in BESS costs- Energy-Storage.News

2 Source: Bloomberg NEF, 2025

3 Hydrogen Headstart program - DCCEEW

4 Japan: Strong fundamentals for energy storage drive expectations despite challenges - Energy-Storage.News

5 Regional Power Grids | EMA

6 h2council.com.au/wp-content/uploads/2022/10/KOR-Hydrogen-Economy-Roadmap-of-Korea_REV-Jan19.pdf

7 EMBER, 2025

8 MOT | Electric Vehicles

9 Battery storage steals the spotlight in Japan’s renewables race

10 Export-scale Hydrogen Production | Australia's Northern Territory,

Hydrogen City Projects – Policies - IEA

Any forecast, projection or target when provided is indicative only and is not guaranteed in any way

Key risks

Risk considerations: there is no assurance that a portfolio will achieve its investment objective or will work under all market conditions. The value of investments may go down as well as up and you may not get back the amount originally invested. Portfolios may be subject to certain additional risks, which should be considered carefully along with their investment objectives and fees.

- Illiquidity: an investment in alternatives is a long-term illiquid investment. By their nature, the alternatives’ investments will not generally be exchange traded. These investments will be illiquid

- Long-term horizon: investors should expect to be locked-in for the full term of the investment

- Technological risk exists when the technology, on the scale proposed for the project, will not perform according to specifications or will become prematurely obsolete. The risk of technical obsolescence following completion becomes particularly important when a project involves a state-of-the-art technology in an industry whose technology is rapidly evolving

- Economic conditions: the economic cycle and prevailing interest rates will impact the attractiveness of the underlying investments. Economic activity and sentiment also impacts the performance of underlying companies and will have a direct bearing on the ability of companies to keep up with interest and principal repayments

- Valuation: these investments may have no or a limited liquid market, and other investments including those in respect of loans and securities of private companies, may be based on estimates which cannot be marked to market until sale. The valuation of the underlying investments is therefore inherently opaque

- Strategy risk: Investments into alternatives may, among other risks, be negatively affected by adverse regulatory developments or reform, credit risk and counterparty risk. The credit market bears idiosyncratic risks such as borrower fraud, borrower bankruptcy, prepayment risk, security enforceability risk, subordination risk and lender liability risk

- Political and economic risks: General economic conditions may affect the activities. Changes in economic conditions, including, for example, inflation, unemployment, competition, technological developments, political events and other factors, none of which will be within the control of the General Partner or the service providers, can substantially and adversely affect the business and prospect investors. Due to the geographic scope of its activities, the strategy may be vulnerable to country or regional-specific political, macroeconomic and financial environments or circumstances

- Investor’s capital at risk: Investors may lose the entirety of invested capital

Important information

For professional clients and intermediaries within countries and territories set out below; and for institutional investors and financial advisors in Canada and the US. This document should not be distributed to or relied upon by retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The capital invested in the fund can increase or decrease and is not guaranteed. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, fund manager’s skill, fund risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Canada by HSBC Global Asset Management (Canada) Limited which provides its services as a dealer in all provinces of Canada except Prince Edward Island and also provides services in Northwest Territories. HSBC Global Asset Management (Canada) Limited provides its services as an advisor in all provinces of Canada except Prince Edward Island;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, and Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not been reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain and Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. None or some of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System – Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website at https://www.assetmanagement.hsbc.ch/ if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2023. All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

0008 / EXP31DEC2024

For Professional Clients only.

Content ID: D051583: Expiry Date: 31.08.2026