ETFs

Single country emerging market ETFs fee cut

HSBC Hang Seng TECH UCITS ETF

We take a pragmatic approach to managing ETFs for our clients, with two equally important objectives: tracking the index closely and minimising costs. Our ETFs offer investors an exposure to a wide range of global, regional and single-country indices.

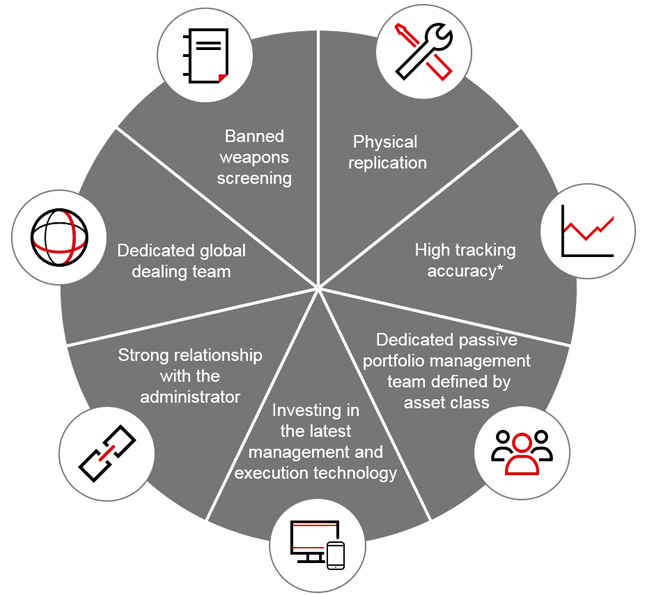

Key benefits of our ETF range

Our investment process aims to efficiently track an index as close as possible. We have a proven track record in providing competitively priced ETF solutions. Our range is supported by the following key benefits:

Physical replication

Our ETFs only invest in the physical stocks which make up the index, also known as ‘physical replication’, and we do not use complicated financial instruments to track the indices.

High index tracking accuracy*

Our experience in managing index funds, means we are able to utilise different implementation techniques and add value where appropriate to ensure our solutions efficiently track the index – while minimising the costs for our clients.

*Please refer to the factsheets for individual fund performance

Enhanced risk management, control and monitoring

As a bank owned asset manager, we are subject to more robust risk parameters and stricter governance rules. Risk management is central to our investment process before, during and after investment decisions are made.

Dedicated global dealing team

At HSBC we have traders located in key regional execution hubs. This means we are able to reduce the high costs normally associated with trading stocks which affect the performance of funds.

Banned weapons stock screening

At HSBC, doing the right things is important to us, we have therefore taken a firm wide ban of investing in companies which produce ‘banned weapons’ as defined by the UN (i.e. chemical weapons and anti-personnel mines).

Large investment in the latest management and execution technology

We have been investing in in-house leading technology to ensure our solutions can benefit from the latest IT developments aimed at delivering cost savings and better performance for our funds and ultimately, for investors.

How to trade our ETFs

To invest in HSBC Asset Management ETFs, please contact your local stockbroker.

Authorised Participants and Market Making contact list

Bank of America Merrill Lynch

Jessica Lana / David Thompson

Email: DG.Delta_One_Trading_Europe@BAML.com

BNP Paribas Arbitrage SNC

Aurelien Cristini

Email: aurelien.cristini@bnpparibas.com

Bluefin Europe LLP

Simon McGhee

Email: europe@bluefintrading.com

Citigroup Global Markets

Andrew J. Jamieson

Email: europe.etf.trading@citi.com

DRW Global Markets Ltd/DRW Europe BV

Bernardus Roelofs

Email: gd1-trading@drw.com

Flow Traders B.V.

Christian Oetterich / Chris Meyers

Email: traders.amsterdam@nl.flowtraders.com

GHCO

Levon Piruzyan

Email: etf@ghco.co.uk

Goldman Sachs International

Rockey Agarwal

Email: Gsetfs@gs.com

HSBC Global Markets

Steve Palmer / Luke Rose

Email: etftradingdesk@hsbcib.com

Jane Street Financial

Slawomir Rzeszotko / Chris Foxon

Email: europe-etfs@janestreet.com

Morgan Stanley

Oliver Morgan

Email: europeanetf@morganstanley.com

Optiver VOF

Holger Schluenzen

Email: ETF@optiver.com

RBC Capital Markets

Matt Holden

Email: euetftrading@rbccm.com

Société Générale SA

Martina Schroettle

Email: europe.etf@sgcib.com

Susquehanna Europe

Salvatore Accurso / Marco Salaorno / Damon Walvoord

Email: etfsaleseurope@sig.com

Virtu Financial

Liam Emery

Email: euetf-trading@virtu.com

Official Market Makers:

Société Générale SA

Martina Schroettle

Email: europe.etf@sgcib.com

GHCO

Levon Piruzyan

Email: etf@ghco.co.uk

For further information, please contact HSBC directly:

HSBC ETFs Capital Market Team

E-mail: etfcapmarkets@hsbc.com

Valentina Riva

Phone: +44 (0)20 3359 5698

E-mail: valentina.riva@hsbc.com

Shareholder communications

|

Document |

|

Date |

|---|---|---|

|

Introduction of Securities Lending |

18 February 2021 |

|

|

HSBC FTSE 100 UCITS ETF - notification to |

10 February 2021 |

|

|

HSBC FTSE 250 UCITS ETF - notification to |

10 February 2021 |

|

|

HSBC MSCI EUROPE UCITS ETF - notification to |

10 February 2021 |

|

|

HSBC MSCI SAUDI ARABIA 20/35 CAPPED UCITS |

2 October 2020 |

|

|

HSBC MSCI SAUDI ARABIA 20/35 CAPPED UCITS |

20 August 2020 |

|

|

Letter of notification to Shareholders regarding |

18 August 2020 |

Securities Lending Programme

From 1 March 2021, HSBC Asset Management will operate a securities lending programme for the benefit of ETF fund investors. Securities lending is a practice within capital markets whereby a holder of a security, such as an ETF, temporarily lends some of its securities out to a borrower in exchange for collateral and a fee. It is a well-established process within the investment management industry used to enhance fund performance through additional income earned.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. For more detailed information on how the programme affects a specific ETF, please visit the Fund Centre and refer to the Securities Lending Programme within the Documents section.

Key risks and important information

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

Key risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

- Exchange Rate risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes the value of the investment to exchange rate fluctuations.

- Derivative risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter (OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade.

- Index Tracking risk: The performance of the Fund may not match the performance of the index it tracks because of fees and expenses, market opening times and regulatory constraints.

- Operational risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk functions which are subject to independent audit and supervised by regulators.

- Liquidity risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the process. The value of assets may be significantly impacted by liquidity risk during adverse market conditions.

- Emerging Market risk: Emerging economies typically exhibit higher levels of investment risk. Markets are not always well regulated or efficient and investments can be affected by reduced liquidity.

- Focused Strategy risk: Funds with a narrow or concentrated investment strategy may experience higher risk and return volatility and lower liquidity than funds with a more diversified approach.

Important information

The HSBC ETF range are sub-funds of HSBC ETFs plc (“the Company”), an investment company with variable capital and segregated liability between sub-funds, incorporated in Ireland as a public limited company, and is authorised by the Central Bank of Ireland. The company is constituted as an umbrella fund, with segregated liability between sub-funds.

Shares purchased on the secondary market cannot usually be sold directly back to the Company. Investors must buy and sell shares on the secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current Net Asset Value per share when buying shares and may receive less than the current Net Asset Value per Share when selling them.

UK based investors in HSBC ETFs plc are advised that they may not be afforded some of the protections conveyed by the Financial Services and Markets Act (2000), (“the Act”). The Company is recognised in the United Kingdom by the Financial Conduct Authority under section 264 of the Act.

The shares in HSBC ETFs plc have not been and will not be offered for sale or sold in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. Affiliated companies of HSBC Asset Management (UK) Limited may make markets in HSBC ETFs plc.

All applications are made on the basis of the current HSBC ETFs plc Prospectus, relevant Key Investor Information Document (“KIID”), Supplementary Information Document (SID) and Fund supplement, and most recent annual and semi-annual reports, which can be obtained upon request free of charge from HSBC Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London, E14 5HQ. UK, or from a stockbroker or financial adviser.

The indicative intra-day net asset value of the sub-fund[s] is available on at least one major market data vendor terminal such as Bloomberg, as well as on a wide range of websites that display stock market data, including www.reuters.com

Investors and potential investors should read and note the risk warnings in the prospectus, relevant KIID and Fund supplement (where available) and additionally, in the case of retail clients, the information contained in the supporting SID.

Contact us

Marc Hall-Spörndli Head of ETF Sales Switzerland

What is an Exchange Traded Fund?

The first Exchange Traded Fund (ETF) was launched in Canada in 1989 and gained their initial popularity by the launch of the first ETF in the US in 1993. ETFs have been available in Europe since 2001. We launched our first HSBC ETFs in 2009 in Europe and currently have a suite of 29 funds.

An ETF is essentially a portfolio of stocks managed by an investment professional just like a traditional mutual fund.

The main difference is that an ETF is listed on a stock exchange, the same as a company. This gives individual investors an opportunity to buy and sell a portfolio of stocks, the same as if they were dealing in a single listed share.

Why choose to invest via an Exchange Traded Fund?

There are many different ways for investors to invest in portfolios but ETFs provide some key characteristics which may appeal to certain investor’s objectives. These include:

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate.

y

y